Devcom 2019

devcom is the official gamescom game developer conference, which paves the way for the gamescom itself. It is a two-day event for a series of talks focused around game development, game publishing, networking and community building.

During devcom I was expecting to get some insights from other companies, like latest numbers for mobile games market in general, learnings from live operations, tips and tricks on publisher-developer relations, etc.

Overall devcom met my expectations. I learned something new and met some cool people.

Below of the list of the talks I’ve attended and my notes for each of them:

- The Next Wave in Mobile Gaming Monetisation

- Improving Monetisation through Behavioural Economics

- Debunking the Myths & telling the Truth about Player Retention

- Forge of Empires Game LiveOps for a 500+ Million LTR Game

The Next Wave in Mobile Gaming Monetisation

Speaker: Tomek Chudzinski, Customer Success Team Lead, EMEA @ AppAnnie

This was a great overview of the overall mobile games busines as of Q2 2019.

Tomek started with fun quiz about about mobile games:

- Color Bump 3D was the most downloaded game of Q1 2019

- Fate/Grand Order was the top grossed game of Q1 2019

- Google Play dominates in game downloads

- App Store vs. Google Play IAP ratio is 65% / 35%

And continued with more in-depth review.

- Mobile games market keeps on growing in 2019. Mobile gaming is set to hit 60% market share of consumer spend in 2019, among all gaming including PC/Mac, handheld and home consoles.

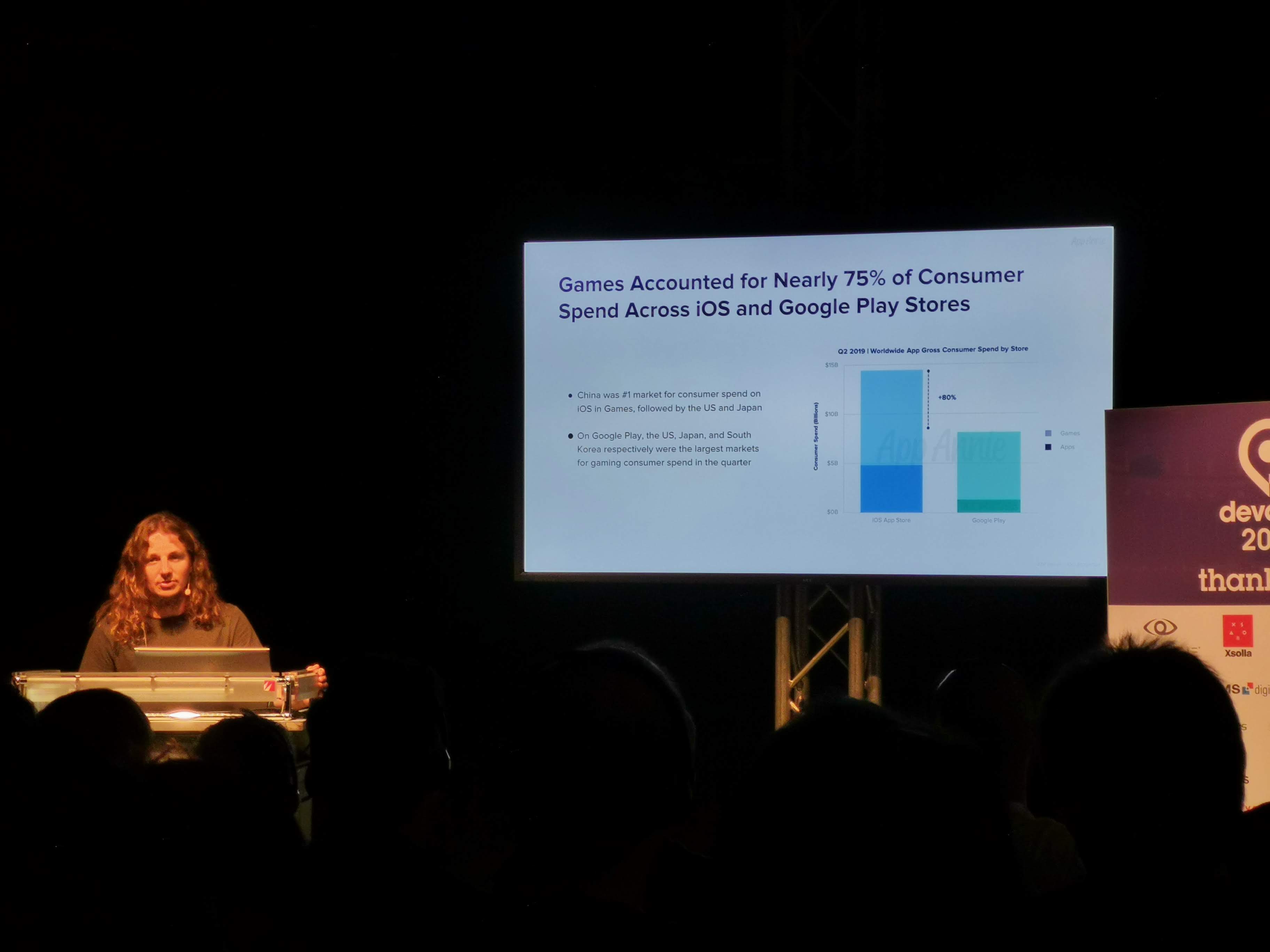

- Games make ~75% of all revenues on iOS and Google Play Stores

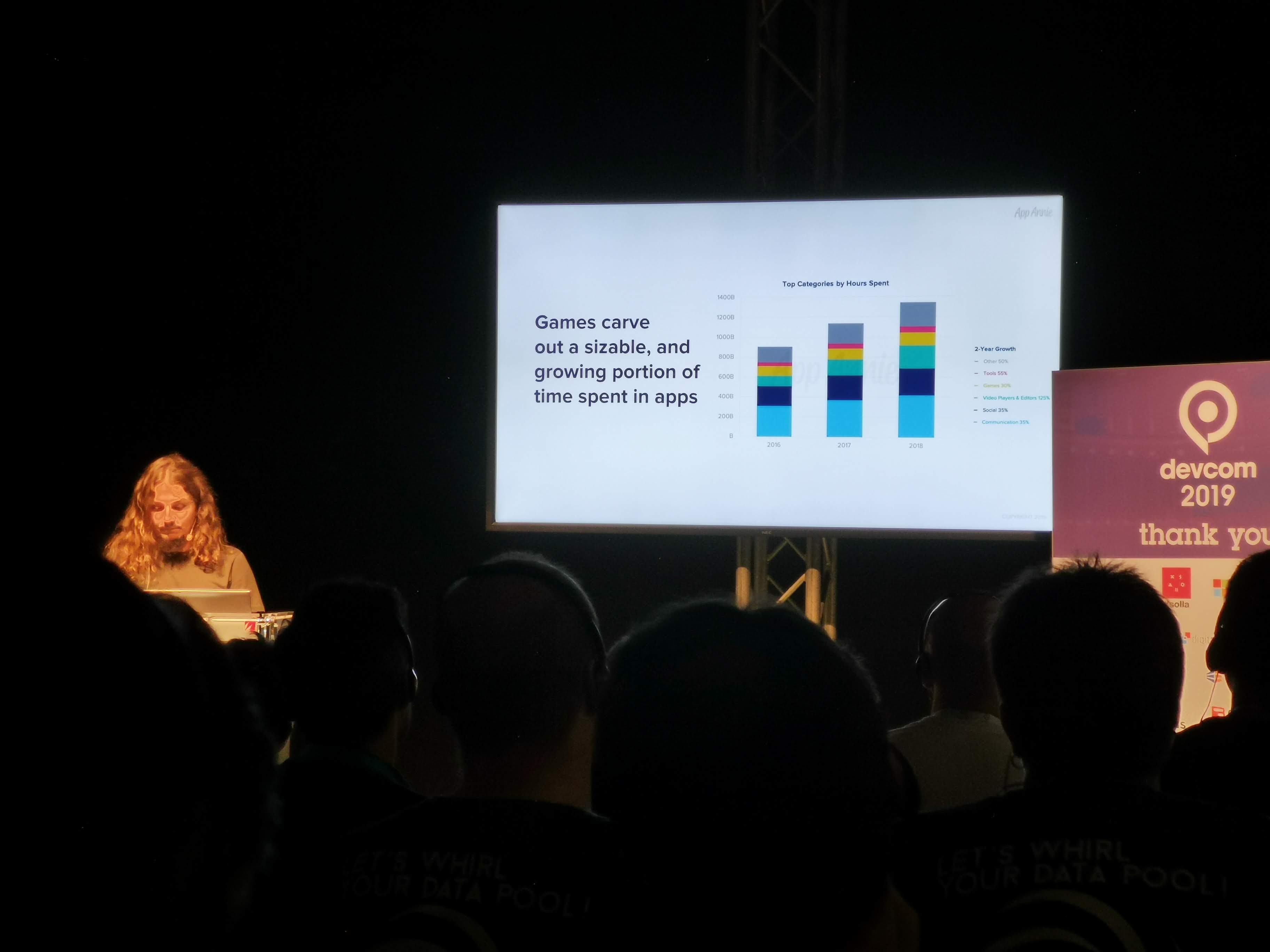

- Users spend around 30% of their time on mobile playing games

- On average mobile users play 4 different games per month

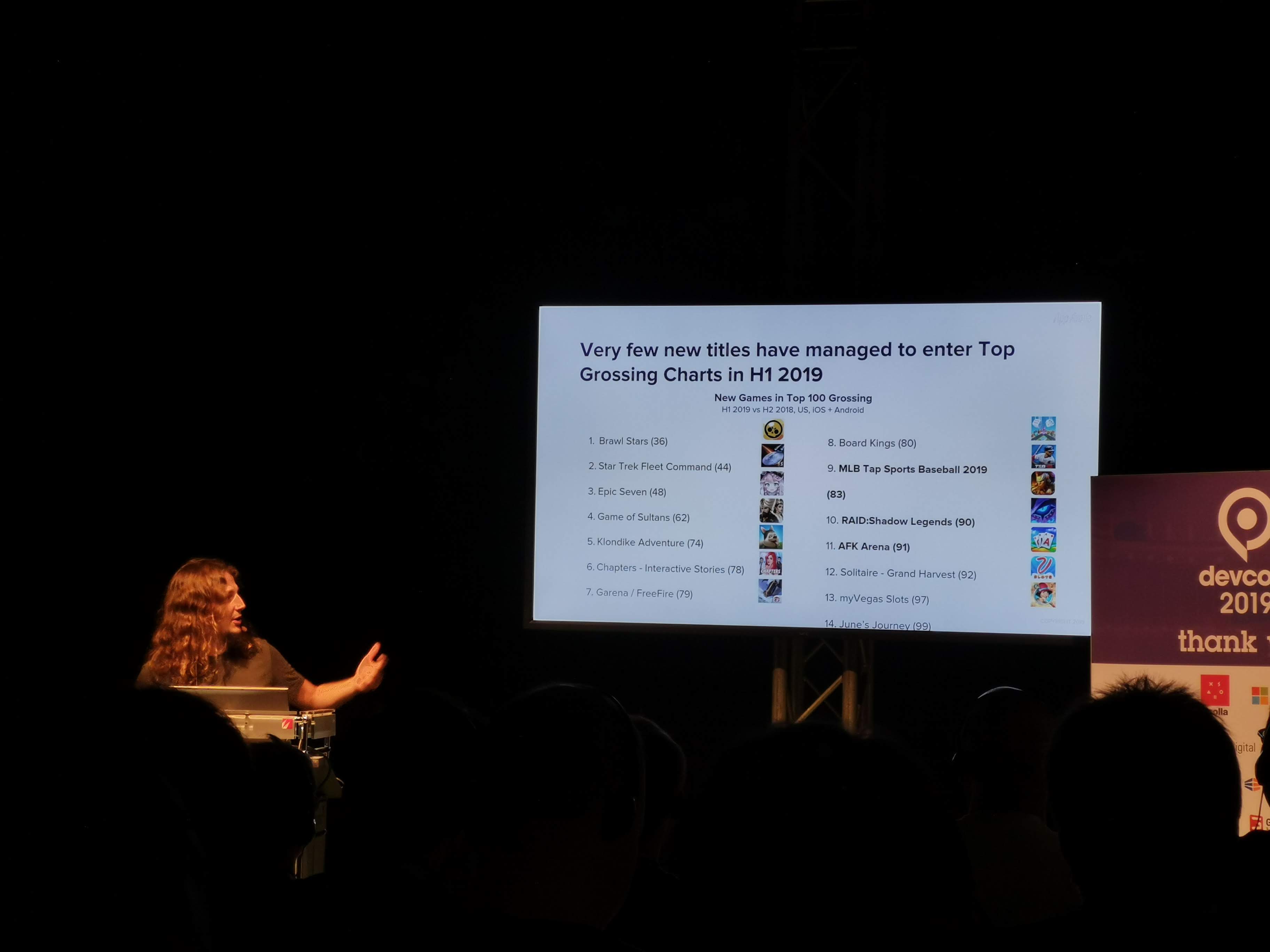

- Very few new titles have managed to enter Top Grossing list in first half of 2019. Some of the best grossing games for H1 2019 are:

- Brawl Stars

- Start Trek Fleet Command

- Epic Seven, Game of Sultans

- Klondike Adventure, Chapters - Interactive Stories

- Garena/FreeFire, Board Kings

- RAID:Shadow Legends

- AFK Arena.

- Revenue opportunities are not only limited to Top Games. The number of games that make over $5M in Annual Consumer Spend raise from 1200 in 2016 to whooping 2200 in H1 2019.

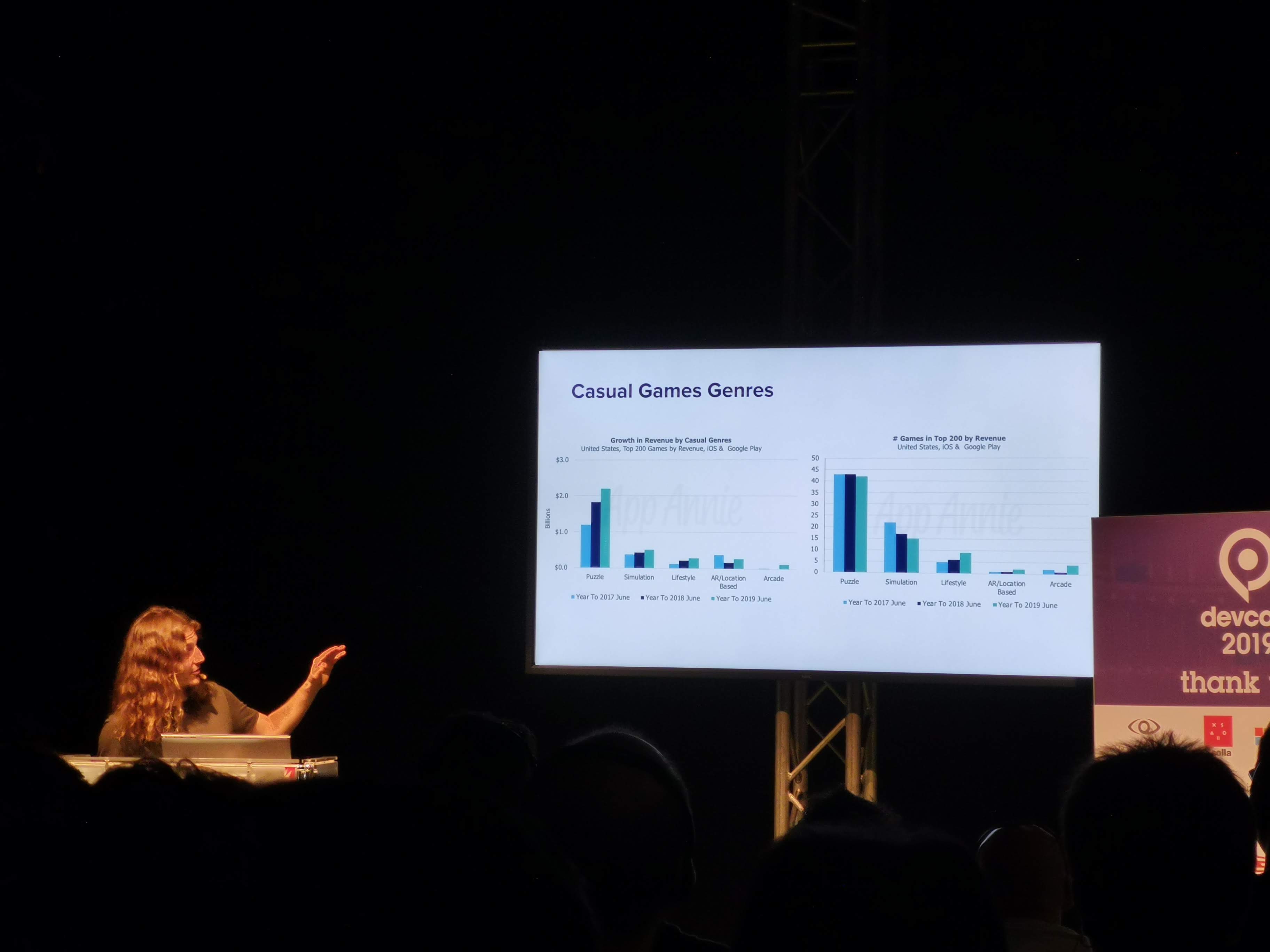

- Puzzle, Simulation and Lifestyle casual games continuosly grow revenues year to year, but that’s tough to enter the genre.

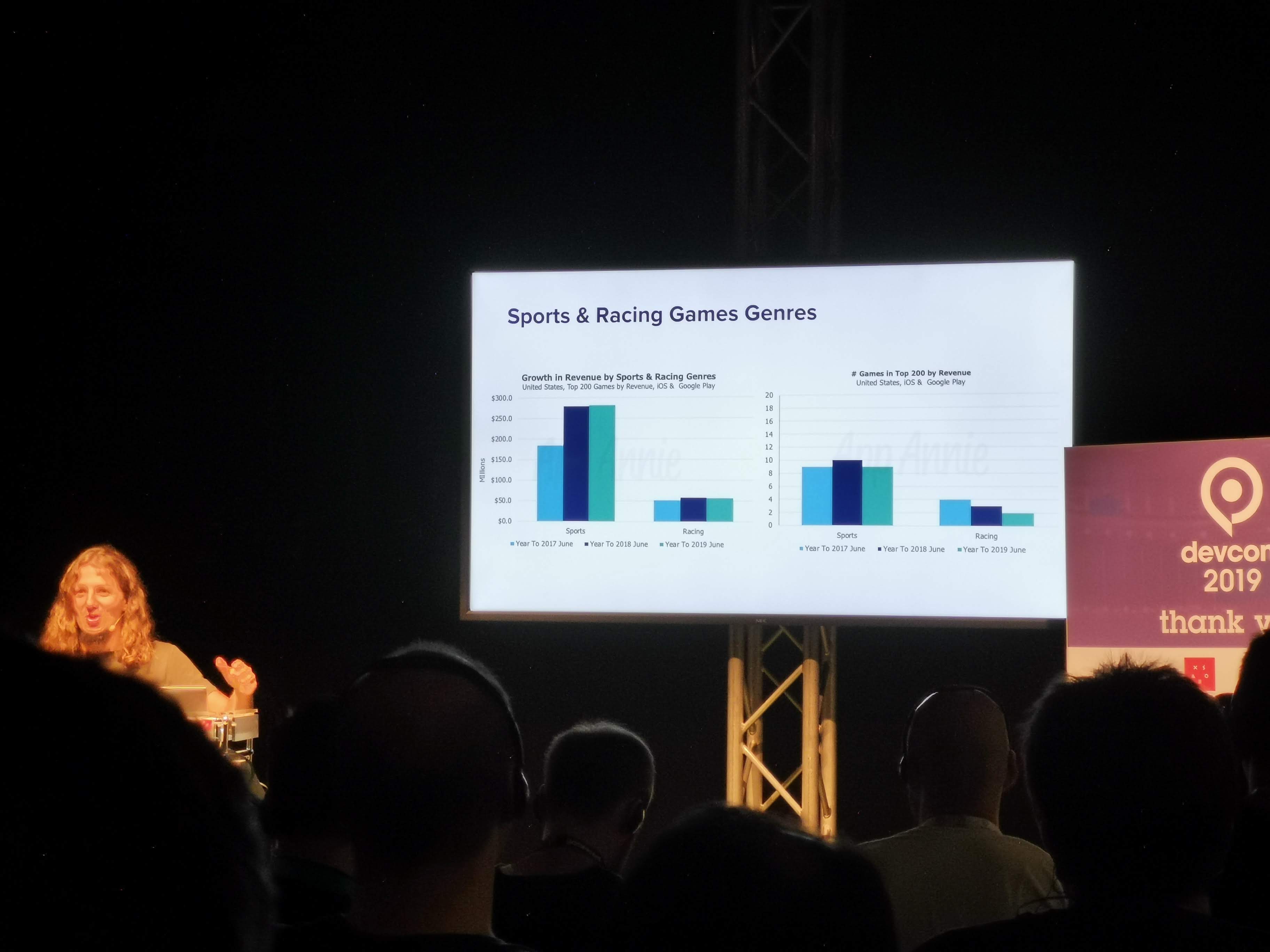

- Number of Sports & Racing Games in top 200 grossing games is shrinking, but ‘big boys’ still manage to get more money

Tomek suggested Game Refinery blog as one of the best sources or new mobile games industry news.

Improving Monetisation through Behavioural Economics

Speaker: Andrew Munden, Live Operations Director @ Space Ape Games

April 2019, Transformers: Earth Wars’ gross booking appeared to be declining faster than predicted – overall, key KPI’s looked good – but something was clearly wrong!

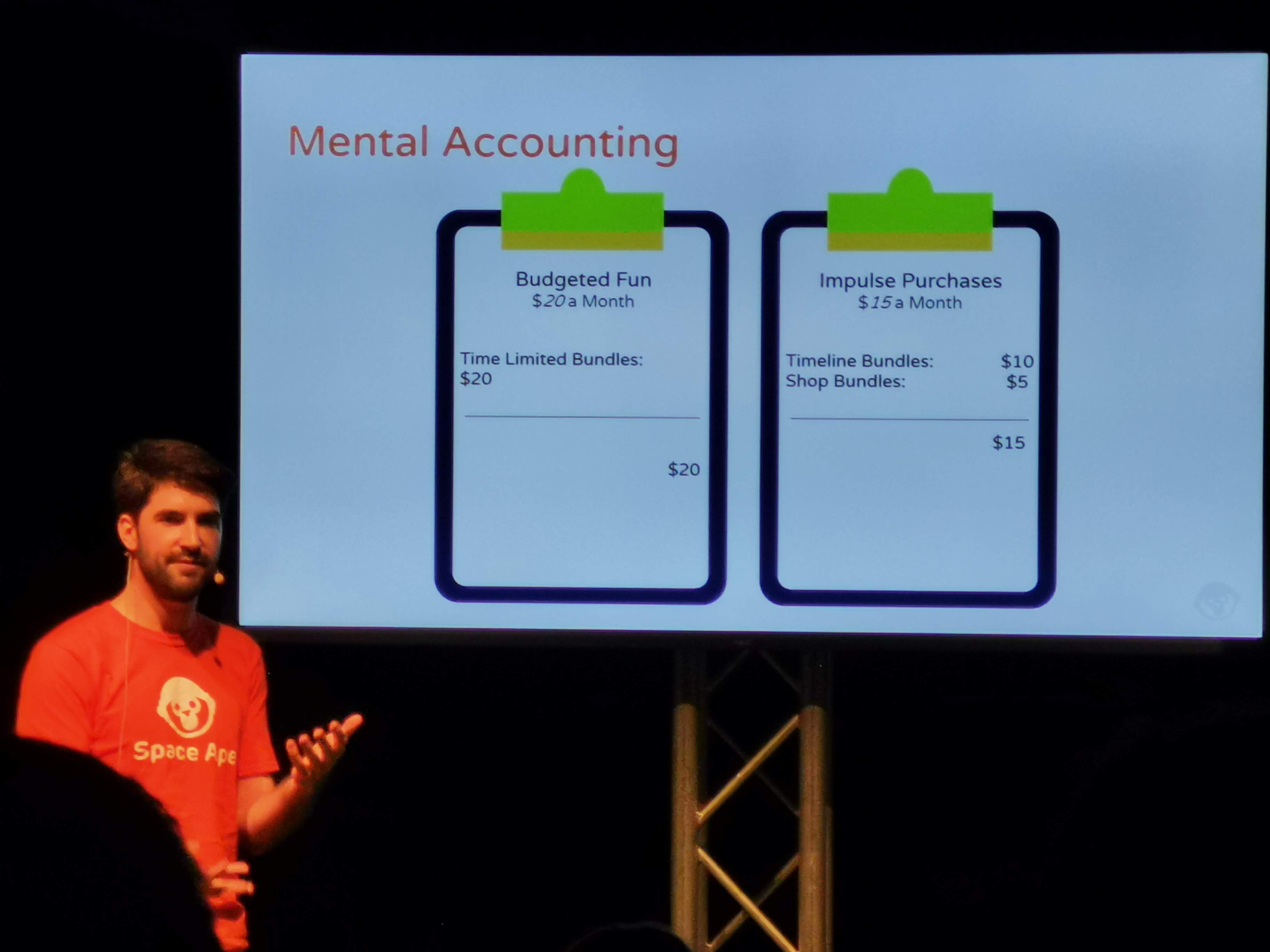

This session was focused on Mental Accounting and how it contributed to the game decline in bookings, how Space Apes Games discovered it, and what they did to address it.

- The problem with declining revenues was linked to new type of special offers which included big amounts of hard currency

- Basically, users were spending their personal monthly budget for fun only on bundles. And, since special offers included hard currency, users would not purchase any more of it.

For example, cadet_93 feels comfortable spending $10/month on hard currency in the game and usually willing to spend another $5 in the same month if s/he sees some valuable special offer.

For example, cadet_93 feels comfortable spending $10/month on hard currency in the game and usually willing to spend another $5 in the same month if s/he sees some valuable special offer.

But, if cadet_93 has already purchased a special offer for $5 with enough hard currency included, s/he is not going to spend that ‘standard’ $10 this month. That means that this player is going to spend only $5 instead of $15.

That's why you need to be really careful using hard currency or try to avoid using it altogether in special offers.

- Try to define the mental accounting for your game’s target player persona.

- Check whales user data and define how much they spend on a game over a month

- What are those purchases? Can you divide them into budgeted fun and impulse purchases categories?

- Your players should have enough ways to spend their monthly ‘fun money’; however, those in-game monetization initiatives should NOT devaluate one another (e.g. as in example with cadet_93)

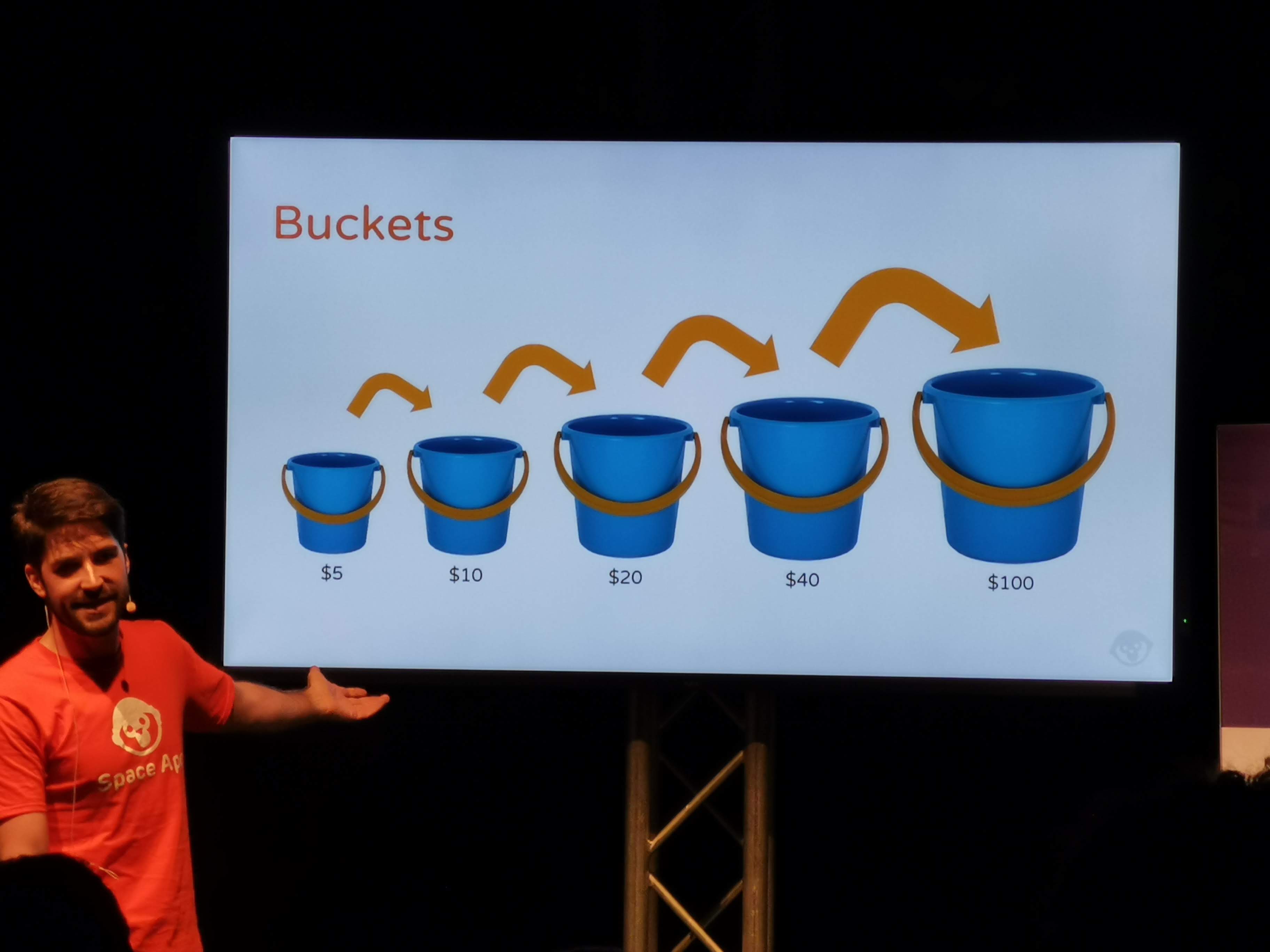

- The product management idea of ‘user buckets’ where you can push a user to spend more and more – from one bucket group to the next – seems to be mainly irrelevant for mobile games.

- Andrew suggests that players have some emotional/behavioral monthly ‘budget’ for games they play – kind of a mental accounting. This is somehow resonates to me personally. You usually are not willing to pay more than you think is fine price tag for a mobile game.

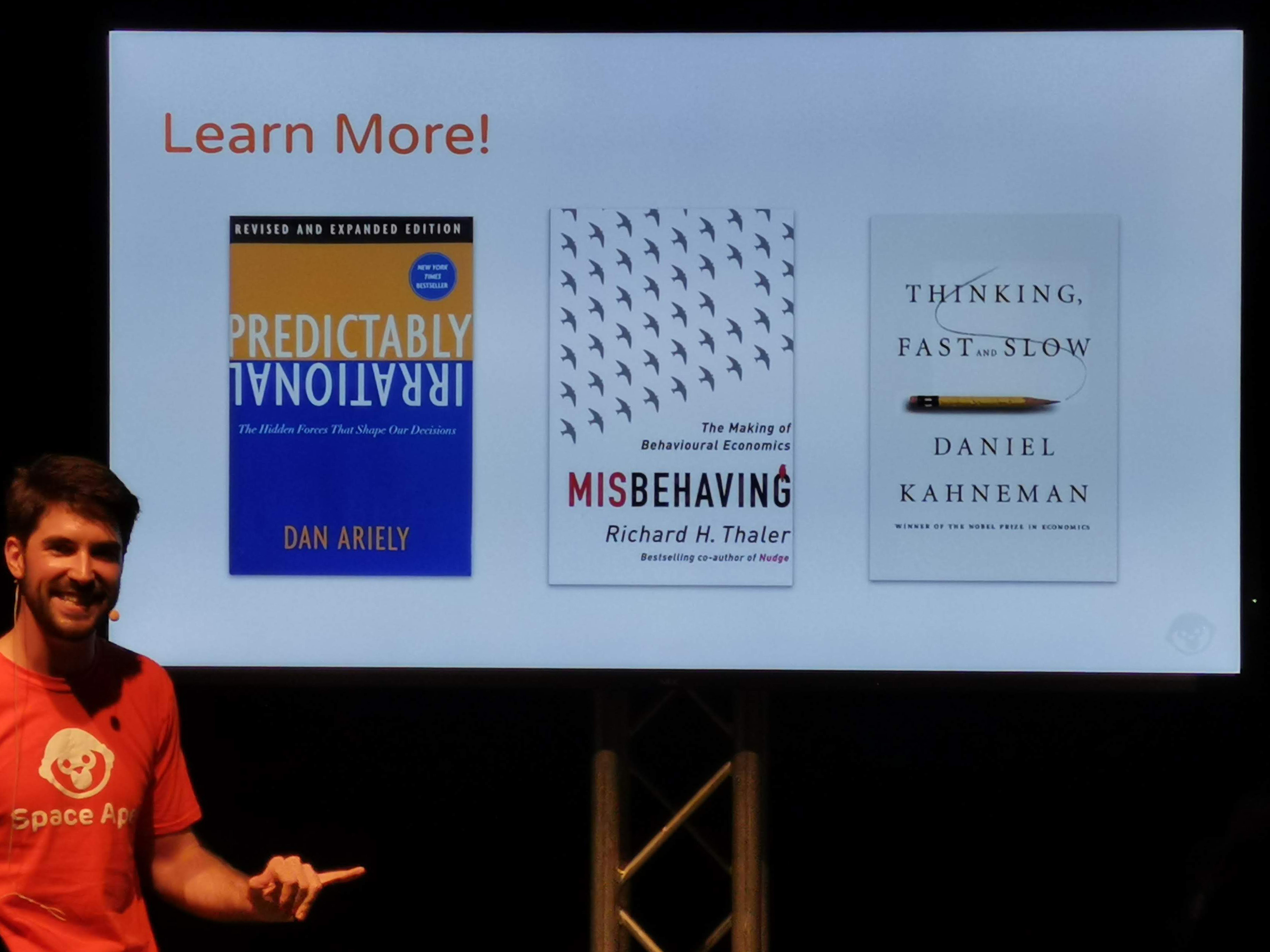

Some of the interesting books that might give a better perspective on Behavioural Economics:

- Thinking, Fast and Slow by Daniel Kahneman

- Misbehaving: The Making of Behavioral Economics by Richard H. Thaler

- Predictably Irrational, Revised: The Hidden Forces That Shape Our Decisions by Dr. Dan Ariely

Debunking the Myths & telling the Truth about Player Retention

Speaker: Oliver Kern, Chief Commercial Officer @ Lockwood Publishing

- Oliver stressed the importance of defining the critical event for any game.

- As described on Amplitude blog,

When you’re measuring retention, the critical event describes the action you want users to perform in order to be counted as truly “active” or “retained.” - Examples of critical event for some well-known products and games:

- 30 followers for Twitter

- 5 racers in 1st day for MMX Racing by Hutch Games

- 2 friends in Avakin Life game (Lookwood Publishing product)

- As described on Amplitude blog,

- Some of the possible way to improve retention in the game:

- adding new content frequently (Avakin Life adds new items twice per week)

- make sales prior to the special events

- Live event on weekends

- change live-ops/events every month

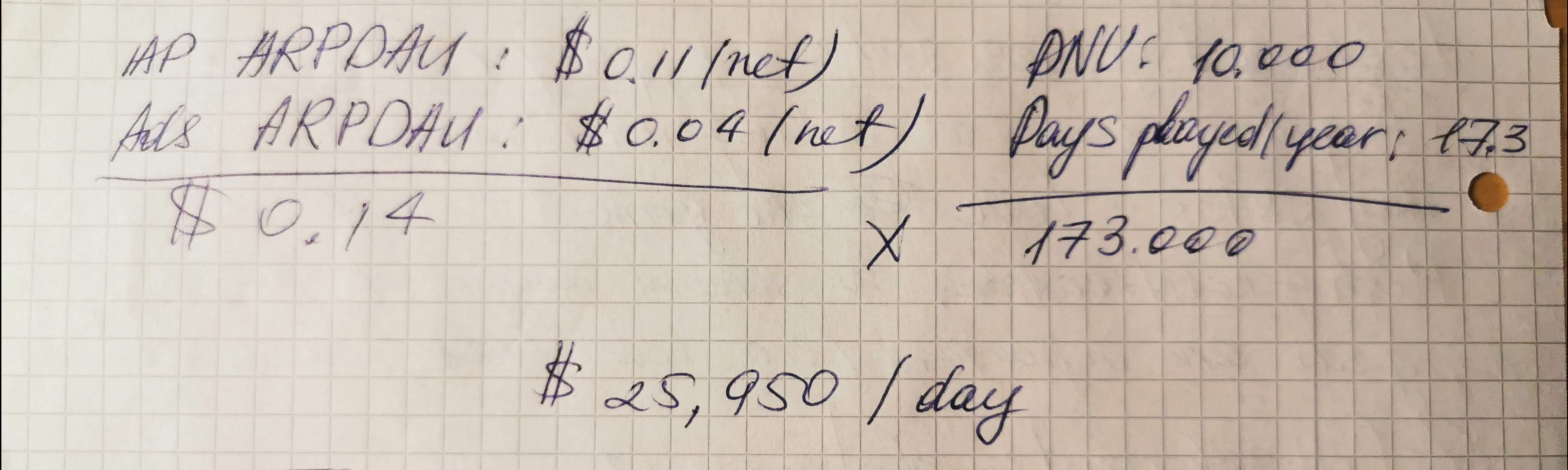

Oliver also shared a way to calculate the approximate daily revenue for a game.

Daily Revenue Model = ARPDAU x DAU

Forge of Empires Game LiveOps for a 500+ Million LTR Game

Speaker: Stefan Walter, Head of Product @ InnoGames

Forge of Empires is a popular online strategy game that has been growing its player base for over 7 years. This means 7 years of live ops and extensive content updates for millions of players to enable constant growth. Stefan provided insights into key learnings from his role as Product Head, leading a team of more than 35 colleagues.

Forge of Empires is a popular online strategy game that has been growing its player base for over 7 years. This means 7 years of live ops and extensive content updates for millions of players to enable constant growth. Stefan provided insights into key learnings from his role as Product Head, leading a team of more than 35 colleagues.

- Forge of Empires have around 4 years of playable content

- Live Ops event usually takes 3-4 weeks

- Late game is important! Early users that play the game over 3 years keep on spending considerable amounts. That’s why Forge of Empires roll out 1 new big ‘civilization’ every year.

- Stefan recommended to release the game only when it has at least 6 months of gameplay and a clear plan for live ops for 24 months.

- Forge of Empires dev team almost abandoned QA as the final step of development. Instead, every developer working on a given feature gathers up all other team members before pushing a commit. This way devs take more time to evaluate their own work before this short presentation. Also, more eyes during presentation make sure that QA guys would not need to deal with evident bugs.